The SEC BlockFi settlement on February 14th was a monumental legal moment for the Cryptocurrency and DeFi space with $100 Million. While the event shed some regulatory insight and presented a pathway to “legitimacy” (according to the SEC), it also raised some issues that may implicate the industry as a whole.

What is BlockFi? And what happened?

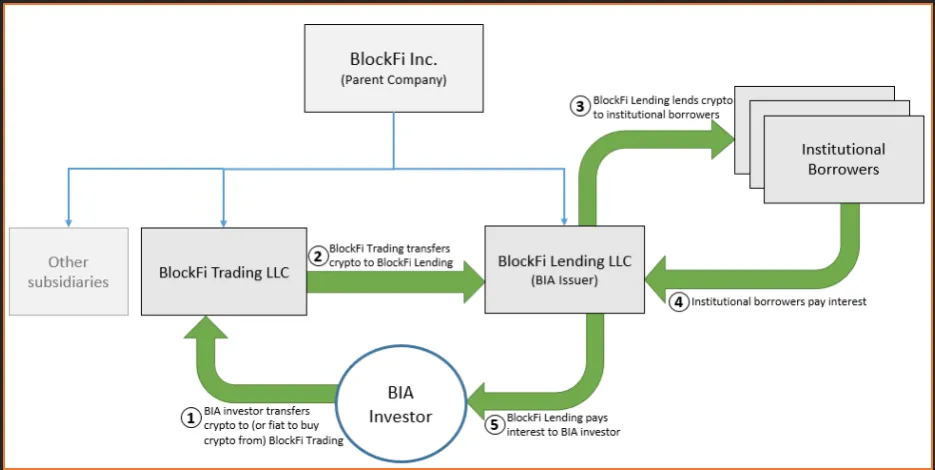

BlockFi is a crypto finance institution headquartered in New Jersey that allows its users to trade, hold, and borrow cryptocurrency through an array of their products. In March 2019, the company launched BlockFi Yield, which allowed users to lend their deposited cryptocurrency and, in exchange, receive interest paid monthly. Some of these BlockFi Interest Accounts (“BIA”) offered an 9.5% annual yield, which dwarfs the average bank savings account rate of 0.06%. BlockFi would then pool investors’ crypto holdings together, and lend it to institutional borrowers. These borrowers would then pay interest to BlockFi, who would take a cut and redistribute the interest to the BIA holders. BlockFi would typically adjust the BIA rates monthly in correlation with how much yield the company received from lending to institutional borrowers.

The product was a hit. By March 2021, BlockFi held about $14.7 billion in BIA investor assets from over 500,000 investors. Since roughly November 2021, the SEC and 32 State Regulatory agencies have been investigating BlockFi for the offering and sale of these BIA accounts. The SEC settled with BlockFi, claiming that the company violated Section 5 and Section 17 of the Securities Act as well as Section 3 of the Investment Company Act. Ultimately, BlockFi agreed to pay a $100 million fine; $50 million will be paid to the SEC, and $50 million will be split between the 32 States who joined this action.

Going Forward for BlockFi

BlockFi must immediately stop offering new BIAs to the public but may continue to service existing ones. However, existing BIA holders cannot deposit more funds into these accounts. Additionally, BlockFi has 60 days (from 2/14/22) to comply with Section 7(a) of the Investment Company Act either through registration via Section 8(a) or by satisfying the Market Intermediary exception. The SEC may also grant a 30-day exception. After that, the SEC stated that BlockFi must file a Form S-1 registration and effectively become a publicly traded company. Additionally, the company intends to file a Form T-1 under the Trust Indenture Act (which describes the entity’s eligibility to act as a trustee under an indenture—a written agreement—with an issuer of debt securities, like bonds).

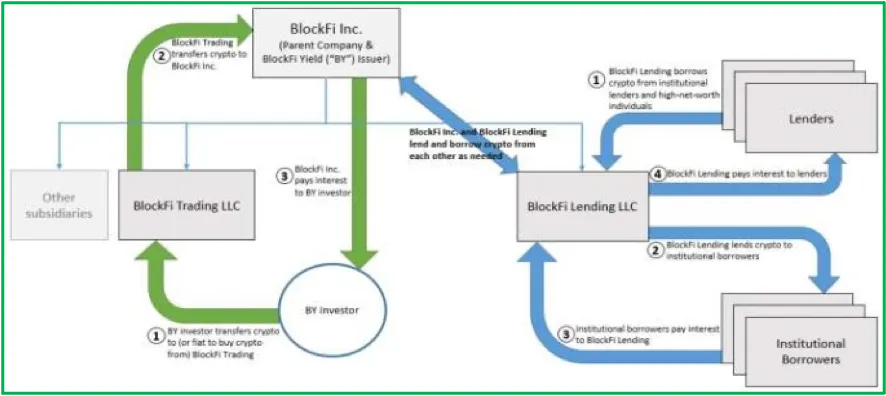

How did BlockFi Work? And How Will it be Structured?

Old Structure

New Structure

Let’s look at how the SEC applied some of the key securities law precedent to the company’s offering and sale of BlockFi Interest Accounts.

The SEC’s Howey Analysis of BIAs

The landmark case of SEC v. Howey is the primary tool used to determine whether certain transactions qualify as an “investment contract” under the Securities Act. If the transaction meets the 4 factors, it is considered a security and subject to regulation by the SEC. What are the 4 factors and how did the SEC apply them to BlockFi? A transaction is an investment contract if: (1) there is an investment of money; (2) an expectation of profits; (3) within a common enterprise; (4) where profit derives from the efforts of others;

The SEC stated that BlockFi’s BIAs constituted an “investment contract” under Howey because:

- [Investment of Money] BlockFi sold BIAs in exchange for the investment of money in the form of crypto assets.

- [Common Enterprise] Each investor’s fortune was tied to the fortunes of the other investors because BIA investor’s returns were a function of the pooling and deployment of the loaned crypt BlockFi deployed those loaned assets. Additionally, BlockFi’s fortune was linked to the investors because the company earned revenue for itself through its deployment of the loaned assets.

- [Expectation of Profits] BlockFi created an expectation that investors would receive profits from the company’s efforts through managing the crypto assets.

- [Efforts of Others] The company had complete control and ownership over the borrowed crypto assets, indicating that profit was derived from their efforts.

SEC’s Application of Reves

The Reves test is an additional test used to determine whether a note should be considered a security. In Reves v. Ernst & Young, the Supreme Court held that a note should be presumed a security unless it bears resemblance to examples of non-security notes. If there is no family resemblance, the court may also consider 4 factors; (1) the motivation of seller and buyer; (2) the plan of distribution of the instrument; (3) the reasonable expectations of the investing public; (4) the presence of an alternative regulatory regime. Here’s what the SEC said on the 4 factors:

- BlockFi offered and sold BIAs to obtain crypto assets for the general use of its business, namely, to run its lending and investment activities to pay interest to BIA investors, and purchasers bought BIAs to receive interest ranging from 0.1% to 9.5% on the loaned crypto assets.

- BIAs were offered and sold to a broad segment of the general public.

- BlockFi promoted BIAs as an investment, specifically as a way to earn a consistent return on crypto assets and for investors to “build their wealth.”

- No alternative regulatory scheme or other risk-reducing factors exist with respect to BIAs.

Implications on the Industry

Impact of Alleged Material Misrepresentations (outdated information on your website)

BlockFi’s website claimed that their loans were “typically” “over-collateralized”. In reality, less than 24% of their loan portfolio was over-collateralized throughout the past 3 years. The SEC further alleged that through “operational oversight, BlockFi’s personnel failed to take steps to update the website statement to accurately reflect” these facts. As such, the SEC alleged that BlockFi violated Section 17(a)(2)(misstatement and omission liability claim) and 17(a)(3) (so-called “scheme” liability). While there is not private right of action for Section 17(a) violations as has been implied under Section 10(b) and Rule 10b-5(b), liability can reach a broader range of activity because no specific intent is required.

This enforcement action underscores the need for ongoing diligence to ensure the accuracy of information presented and representations made about a crypto or DeFi project through promotional materials, social media posts, and on websites as proof of scienter is not required to trigger potential liability. Misrepresentation regarding the overall status of collateralization is tough to defend. It’s important to note that the standard for review for this violation is negligence. However, there is a silver lining (perhaps). If information asymmetry is the problem, then perhaps DeFi is the solution. Regardless, websites should make sure that any information regarding material information is accurate.

Investment Company Act Concerns and Dissent within the SEC

The SEC also found that BlockFi violated Section 7 of the Investment Company Act. More specifically, Section 7(A) of the Investment Company Act holds that it is unlawful for an unregistered investment company to offer or sell any security via interstate commerce. HOWEVER, there is a catch (here comes the silver lining). The Investment Company Act specifically excludes any company that is primarily a “market intermediary” as defined in Section 3(c)(2) of the act. A market intermediary is any company that enters into transactions on both sides of the market. For example, a business that is primarily engaged in underwriting and distributing securities issued by others, acting as a broker, would likely fit this classification. By meeting this definition, lending platforms can avoid regulation under the ICA because they will not be considered an “Investment Company”. Ultimately, the SEC held that BlockFi has not been a “market intermediary”, but has the ability to become one.

SEC Commissioner, Hester Peirce, offered her dissent to this settlement decision and expressed her pause regarding the use of the market intermediary exception. For reference, there are 5 commissioners in the SEC. At the helm is the Chair – Gary Gensler. Commissioner Peirce expressed that the SEC was not always fair with good-faith actors like BlockFi. She also offered great insight into the practical implications of this settlement. Peirce explained that BlockFi is possibly in a Catch-22 because the company may not be able to register as an investment company via Section 8(a) of the Investment Company Act since they issue debt securities. The dissenting commissioner further warned that this market intermediary exemption is rarely used and may be problematic when applied to crypto companies.

Additionally, Commissioner Peirce was very skeptical of the timeframe given to BlockFi. She explained that expecting BlockFi to provide sufficient evidence that the company falls within an exception within 60 (plus 30) days is “extremely ambitious”. Alternatively, she offered, that the Commission could create a more tailored regulatory framework for BlockFi (and presumably other BIA companies) under Section 6(c) of the Investment Company Act. While her dissent merely outlines her frustrations, it could be indication that further regulatory clarity is on its way. And since Biden’s executive order on March 9th, the industry has its fingers crossed.

Applicability of BlockFi Settlement for DeFi Arrangements

Although BlockFi markets itself as one, the company may not be the paradigm for DeFi Lending platforms. The BIA loans were received, pooled, and reinvested by BlockFi. Then the interest payments were collected and redistributed by BlockFi. This does not seem that decentralized. Therefore it is difficult to ascribe the direct ramifications on all DeFi platforms considering their difference in structure. This was not the first time that the SEC brought an enforcement action against a D.I.N.O. (DeFi In Name Only) Company.

In 2008, the SEC went after Prosper Marketplace, a Pier-to-Pier lending platform where the company connected lenders and borrowers, prohibiting them from disclosing their actual identities and connecting with each other directly. In the enforcement action, the SEC described how “Lenders rely on the efforts of Prosper because Prosper’s efforts are instrumental to realizing a return on the lenders’ investments.” Alternatively, sufficiently decentralized platforms, where the company does not control loan terms, how loans are transacted, or how the loans are paid off, may be able to avoid a similar fate to BlockFi and Prosper.

More recently, in the SEC’s 2019 Framework for “Investment Contract” Analysis of Digital Assets statement, the agency stressed the importance of the Expectation of Profits and Efforts of Others prongs of Howey. However, this statement came at a time when the majority of the crypto space were Layer 1 token projects. It’s also important to note that it may be difficult to apply the Commonality test of Howey to DeFi platforms. Why? Because the decentralized nature of DeFi breaks the commonality between lenders, borrowers, and the platform. Additionally, it may be challenging to apply the Reves test to DeFi platforms. It is possible that DeFi could skirt away from the Reves test as a whole by making the argument that these loans are not notes. Typically, a note is a two-party negotiable instrument. With DeFi, the decentralized nature differs from the traditional bilateral structure since lenders and borrowers would be interacting directly with the protocol. Additionally, it is possible that companies only offer the interest accounts for 9 months per user in order to fall outside the statutory coverage.

SEC’s Recommended Pathway Going Forward

Although the SEC has claimed a crypto company was in violation of the Investment Company Act before, this is the first time the agency made allegations against a current crypto interest rate account company. The SEC’s recommended pathway for BlockFi and other crypto interest account offerors via Section 8(a) or an exception to the Investment Company Act is certainly novel. Previously, the SEC instructed the companies to file as a security under Section 12(g) of the 1934 Act and make timely reports as per Section 13(a) of the 1934 Act. Ultimately, however, BlockFi would have to file a Form S-1 and start the process of becoming a publicly-traded company.

Obviously, becoming a publicly-traded company is a massive undertaking… but what if you already are one? There is a question of whether this reopens the door for Coinbase Earn, Coinbase’s failed interest account platform. Remember, in order to become a market intermediary, BlockFi must borrow crypto from institutional lenders and/or high net-worth individuals. What could this mean for a company like Grayscale Trust, could they offer an additional product? Could we see players like SoFi make an Interest Account? Could we see cooperation among lending/borrowing companies to create more working capital in the space? Also, considering how costly it is for a company to go public, could we see crypto SPACs? Hopefully, regulatory clarity is on its way, DeFi companies can continue to offer competitive products, and the SEC can properly protect consumers.